We are often told that once we grow our wealth, we need to take steps to protect it. But what if there was a way to protect both your growing investment and your health at the same time? Optima Care Invest allows you to do just that. It takes the stress out of finding an insurance cover to work alongside your investment portfolio by combining the two into the one package, tailored to suit your lifestyle and financial goals. Let us help you create a financial plan, and watch your financial investment grow with the peace of mind that HSBC and Allianz are together invested in your health. So, what are you waiting for? The market has just opened and Optima Care Invest is the right investment for you – for life.

Optima Care Invest

Optima Care Invest is a packaged solution that allows you to enjoy your tailored, medium to long term investments in the Indonesian and Asia Pacific capital markets while providing life insurance cover for any unforseen personal risks to your health including accidental death and disability.

How Do I Begin?

- Understand the risk. Investing also carries a certain amount of risk, and the bigger the potential return, the greater the risk you have to take. To figure out the risk involved in an investment, understanding volatility is essential. A higher volatility brings with it a greater risk. Generally, there are 3 levels of risk: Conservative, Medium and Aggressive. It is important to consider your acceptance threshold for risk before creating a financial plan. Higher volatility comes with greater risk. Generally, there are 3 types of risk acceptance – Conservative, Medium and Aggressive. It is important to consider your acceptance towards risk before creating a financial plan.

- Create financial plan. After understanding your risk threshold, you can start creating a financial plan. To begin, you have to clearly define your investment goals such as Capital Growth, Income, Capital Preservation and Liquidity. In addition, you need to keep in mind several other factors when creating a solid financial plan to help you achieve your investment goals such as the Amount Invested, Length of Time to Invest, and the Potential Return of Investment.

- Select the right solution. The rapid economic growth in the Indonesian and Asia Pacific capital markets presents exciting investment opportunities and a promising vehicle to help you achieve your investment goals.

Optima Care Invest Privileges

- Optimize Your investment growth

With a 105.26% allocation from the Total Premium (Single Premium + Single Top Up), your investment growth will be maximized in the future.

- Life, Accidental Death and Disability protection for peace of mind

Optima Care Invest provides protection of 150% of a single premium in the event of death, death benefits given twice in events of accidental death, and benefits up to 150% of single premium in events of disability.

- No medical Checkup and No Additional Cost

No medical check-up is required for sum assured up to Rp300,000,000 (USD 30,000), and there are no admin fees, top up fees or switching cost when you sign up with Optima Care..

- Variety of Investment Instrument

You can choose where to invest according to your risk profile and even have the option to invest in the Indonesian and Asia Pacific capital markets.

- Flexible Surrender Benefit

If you surrender the policy at any time while it is active, the value of the fund at that time will be paid to the policy holder.

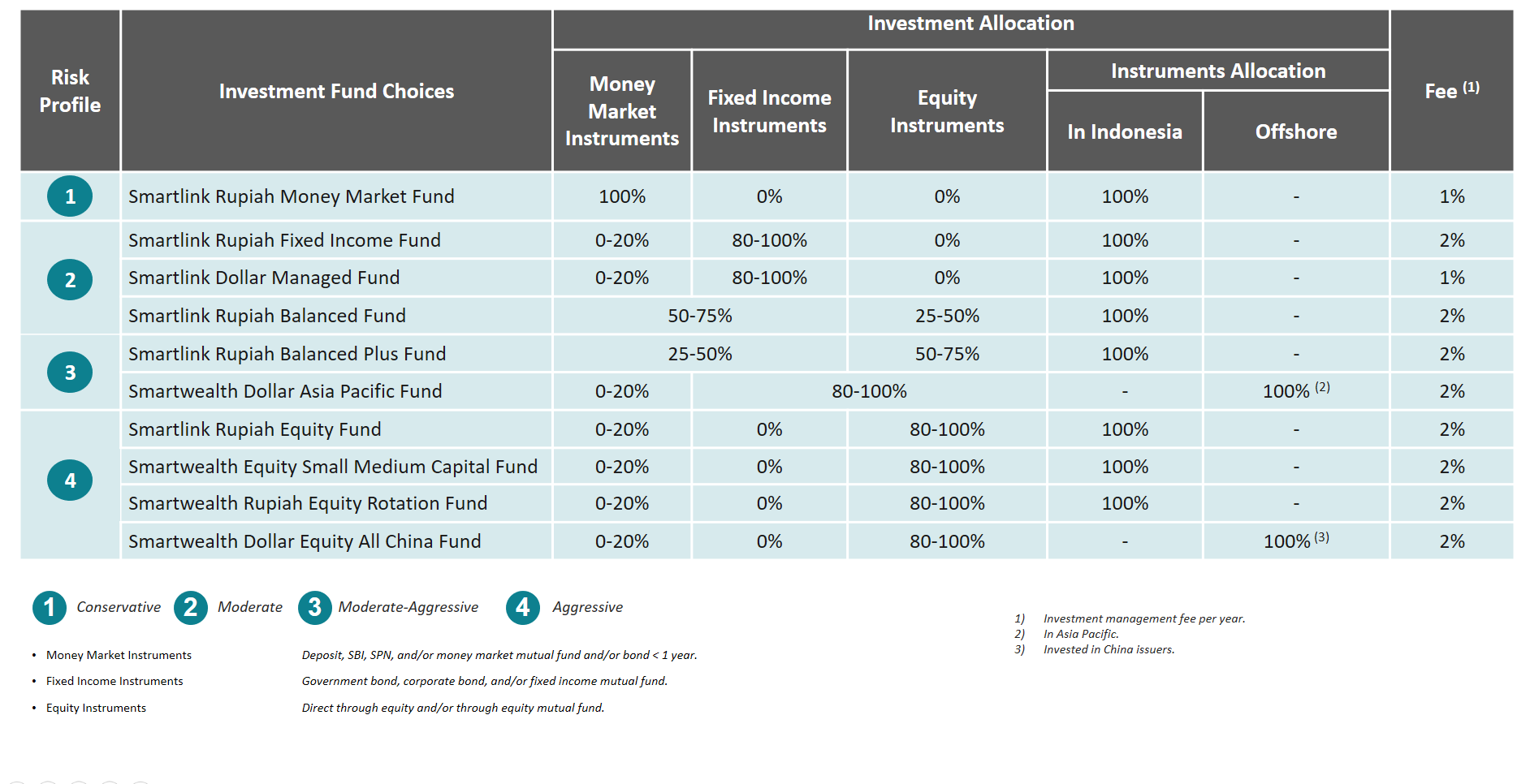

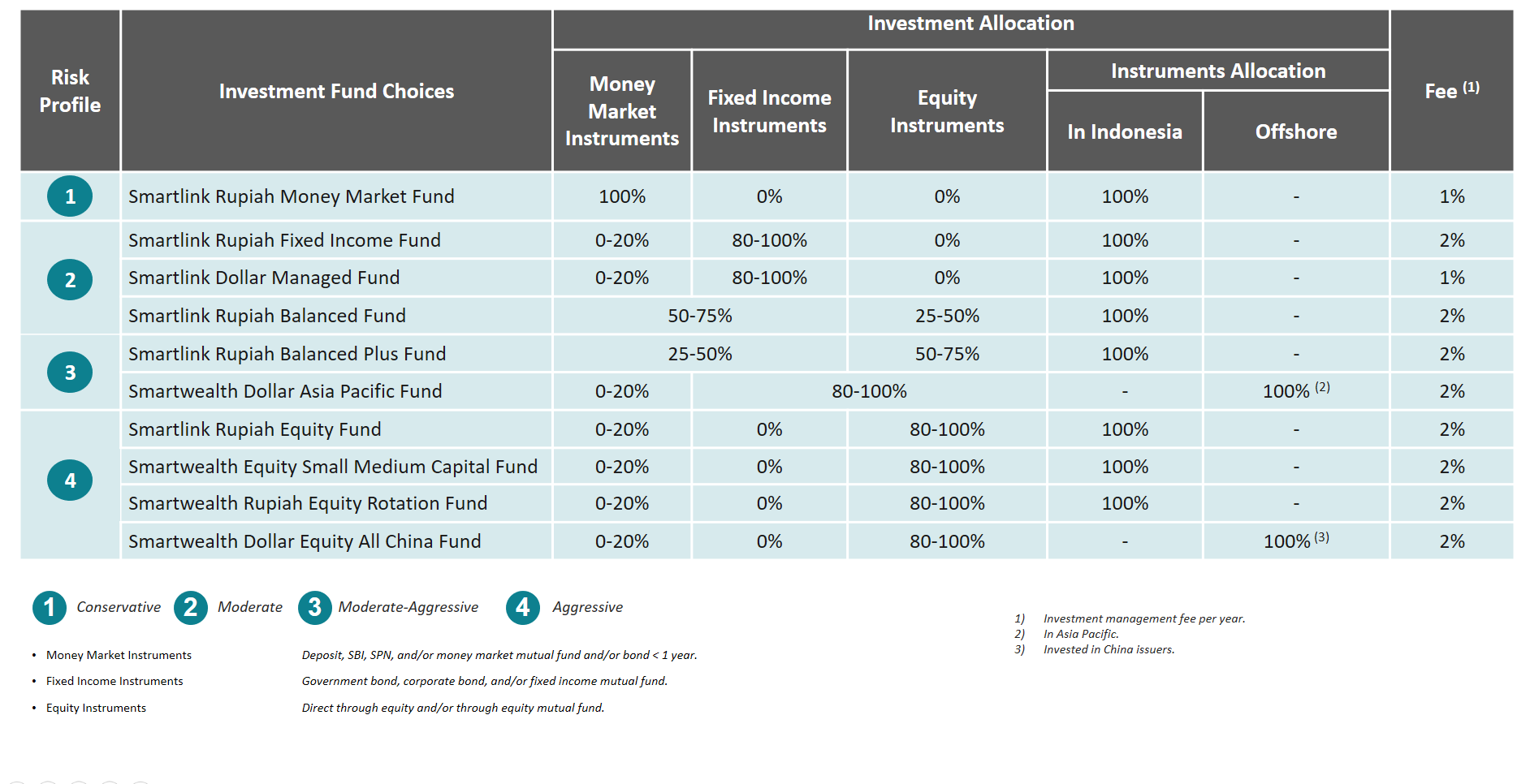

Investment Fund Choices

Care Invest Plus provides the following investment choices to grow your investments and realise your lifelong dreams:

Optima Care Invest Benefits

- Death Benefit 150% Single Premium + Investment Value (up to 75 years old)

- Disability Benefit due to Accident Up to 150% Single Premium + Investment Value (Up to 65 years old)

- Accidental Death Benefit 300% Single Premium + Investment Value (up to 65 years old)

- Maturity Benefit Investment Value.

Full details of applicable charges are provided in the General and Special Terms and Conditions of the Optima Care Invest policy.

1 This benefit is accelerated which will reduce the sum assured for the accidental death benefit.Return to main text

2 No medical check-up applies to certain Allianz products held by customers. No Fee switching transactions may occur up to 4 times/ year, any further switching in that year will incur a charge IDR 50,000/ USD 5 per transaction.Return to main text

Optima Care Invest is an insurance product issued by PT. Asuransi Allianz Life Indonesia and is not a bank product. Thus, it is not guaranteed by PT Bank HSBC Indonesia and/or any member or members of HSBC Group (HSBC Holdings Plc and its subsidiaries and associate companies or any one of their branches), and is not included in the government's loan guarantee program or deposit guarantee program. HSBC accepts no responsibility for any insurance policy issued by PT. Asuransi Allianz Life Indonesia associated with the Optima Care Invest program outlined herein. Use of the HSBC logo is subject to the approval of HSBC as a symbol of cooperation between HSBC and PT. Asuransi Allianz Life Indonesia for the express purpose of offering the Optima Care Invest products outlined herein. HSBC is neither an agent of PT. Asuransi Allianz Life Indonesia nor a broker of any HSBC customer. Any use of HSBC's corporate logo in relation to any Optima Care Invest product is purely an indication of the marketing cooperation between HSBC and the insurance company offering the insurance program.

Investasi pada asuransi unit link mengandung resiko pasar, suku bunga, likuiditas, kredit dan resiko lainnya, termasuk kemungkinan kehilangan modal pokok yang diinvestasikan. Investor wajib membaca dan memahami Dokumen Fitur Produk, Formulir Pernyataan, Syarat dan Ketentuan Produk Asuransi Unit Link Pihak Ketiga, brosur pemasaran, dokumen-dokumen dan referensi lain yang berhubungan dengan produk ini untuk faktor-faktor resiko, biaya-biaya dan hal-hal lainnya sebelum berinvestasi pada asuransi unit link. Kinerja masa lalu bukan merupakan indikasi kinerja di masa yang akan datang.

Nilai investasi dapat naik ataupun turun sesuai dengan kondisi pasar dan kualitas efek portofolio Sub-dana yang bersangkutan serta faktor-faktor lainnya yang mempengaruhi nilai aset-aset yang mendasari jenis sub-dana asuransi unit link tersebut.

ASURANSI UNIT LINK ADALAH PRODUK ASURANSI DAN PASAR MODAL YANG DIATUR OLEH ASOSIASI ASURANSI JIWA INDONESIA DAN OTORITAS JASA KEUANGAN (OJK).

INVESTASI PADA ASURANSI UNIT LINK TIDAK TERMASUK DALAM CAKUPAN OBYEK PROGRAM PENJAMINAN PEMERINTAH ATAU PENJAMINAN SIMPANAN OLEH LEMBAGA PENJAMINAN SIMPANAN.

BANK HANYA BERTINDAK SEBAGAI PEMBERI REFERRAL DAN TIDAK MEMBERIKAN GARANSI TERHADAP INSTRUMENT, MODAL DAN HASIL INVESTASI. BANK TIDAK BERTANGGUNG JAWAB ATAS SEGALA TUNTUTAN DAN RISIKO ATAS PENGELOLAAN PORTFOLIO SUB-DANA. BANK TIDAK MEMBERIKAN SARAN INVESTASI APAPUN TERKAIT DENGAN PRODUK INI.

INVESTASI MELALUI ASURANSI UNIT LINK MENGANDUNG RESIKO. CALON INVESTOR WAJIB MEMBACA DAN MEMAHAMI DOKUMEN FITUR PRODUK, SYARAT DAN KETENTUAN PRODUK ASURANSI UNIT LINK PIHAK KETIGA, BROSUR DAN DOKUMEN-DOKUMEN LAINNYA TERKAIT DENGAN PRODUK SEBELUM MEMUTUSKAN UNTUK BERINVESTASI MELALUI ASURANSI UNIT LINK INI. KINERJA MASA LALU TIDAK MENCERMINKAN KINERJA MASA DATANG.

KINERJA PRODUK INI DI MASA LALU TIDAK MENCERMINKAN KINERJA PRODUK INI DI MASA YANG AKAN DATANG. SESUAI DENGAN JENIS DARI SUB-DANA, NILAI DARI INVESTASI DAPAT BERUBAH NAIK ATAUPUN TURUN AKIBAT FLUKTUASI NILAI AKTIVA BERSIH (NAB) SESUAI DENGAN KONDISI PASAR DAN KUALITAS EFEK PORTOFOLIO SUB-DANA YANG BERSANGKUTAN SERTA FAKTOR LAIN YANG MEMPENGARUHI NILAI ASET YANG MENDASARI PORTOFOLIO SUB-DANA UNIT LINK.

HALAMAN INI BUKAN MERUPAKAN PENYEBARLUASAN INFORMASI, PENAWARAN UNTUK MENJUAL ATAU AJAKAN UNTUK MEMBELI PRODUK ASURANSI UNIT LINK DAN/ATAU SUB-DANA UNIT LINK OLEH SIAPAPUN DALAM SEMUA WILAYAH YURIDIS YANG DILARANG OLEH HUKUM ATAU KEPADA SIAPAPUN YANG DILARANG SECARA HUKUM UNTUK MENGAJUKAN PENAWARAN INI ATAU MENYEBARLUASKAN HALAMAN INI.

APABILA TERDAPAT PERBEDAAN ANTARA DATA ASURANSI YANG DIBERIKAN OLEH BANK DENGAN DATA ASURANSI YANG DIKELUARKAN/DITERBITKAN OLEH PERUSAHAAN ASURANSI MAKA NASABAH WAJIB UNTUK MENGACU KEPADA DATA YANG DIBERIKAN OLEH PERUSAHAAN ASURANSI.