Take control of your finances with a single app

Enjoy the freedom to manage transactions anytime, anywhere with ease.

Monitor the latest transactions from your accounts and credit card. And easily manage your payments from monthly bills and credit to e-wallet balance top-ups.

Benefits of mobile banking

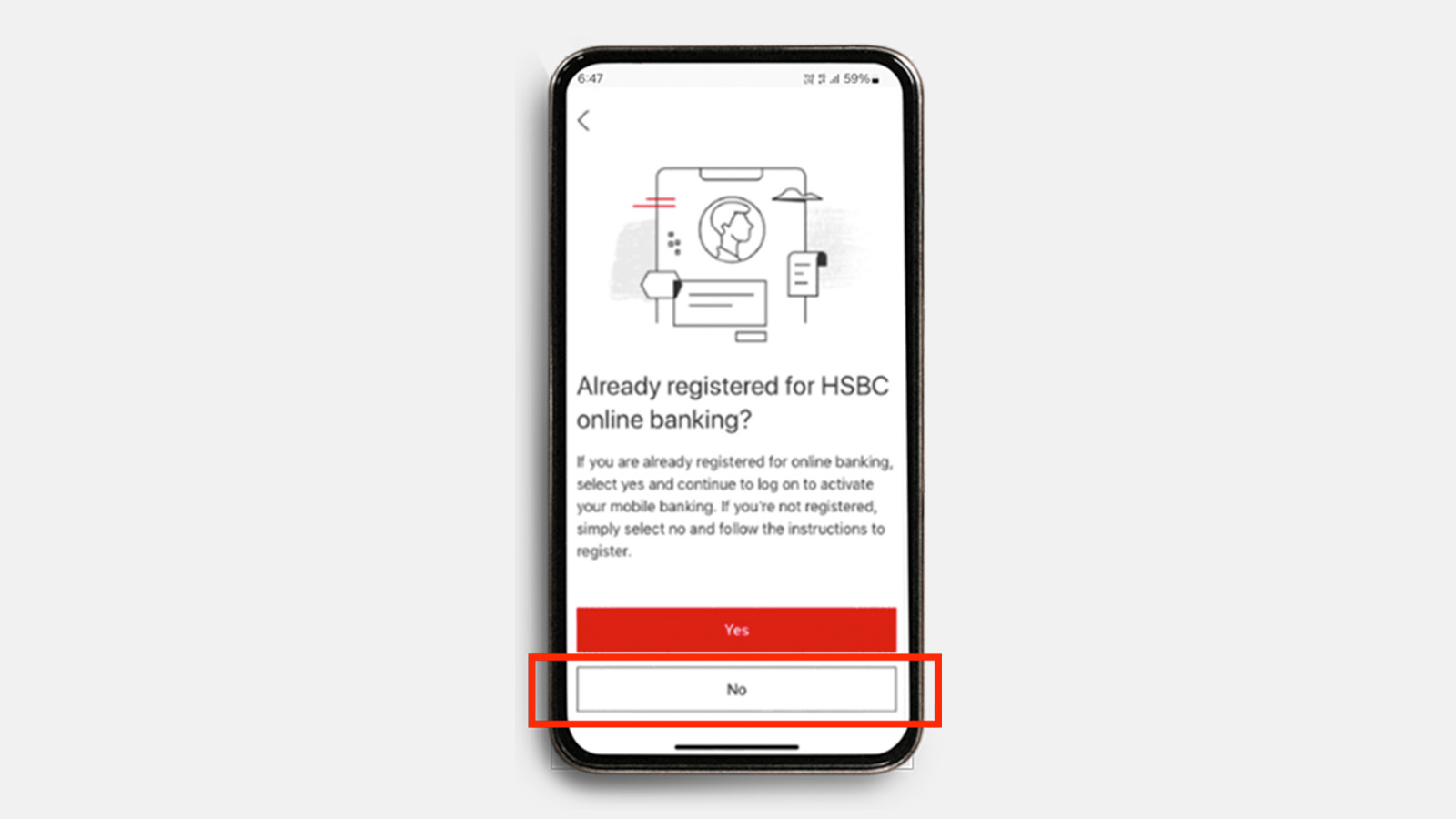

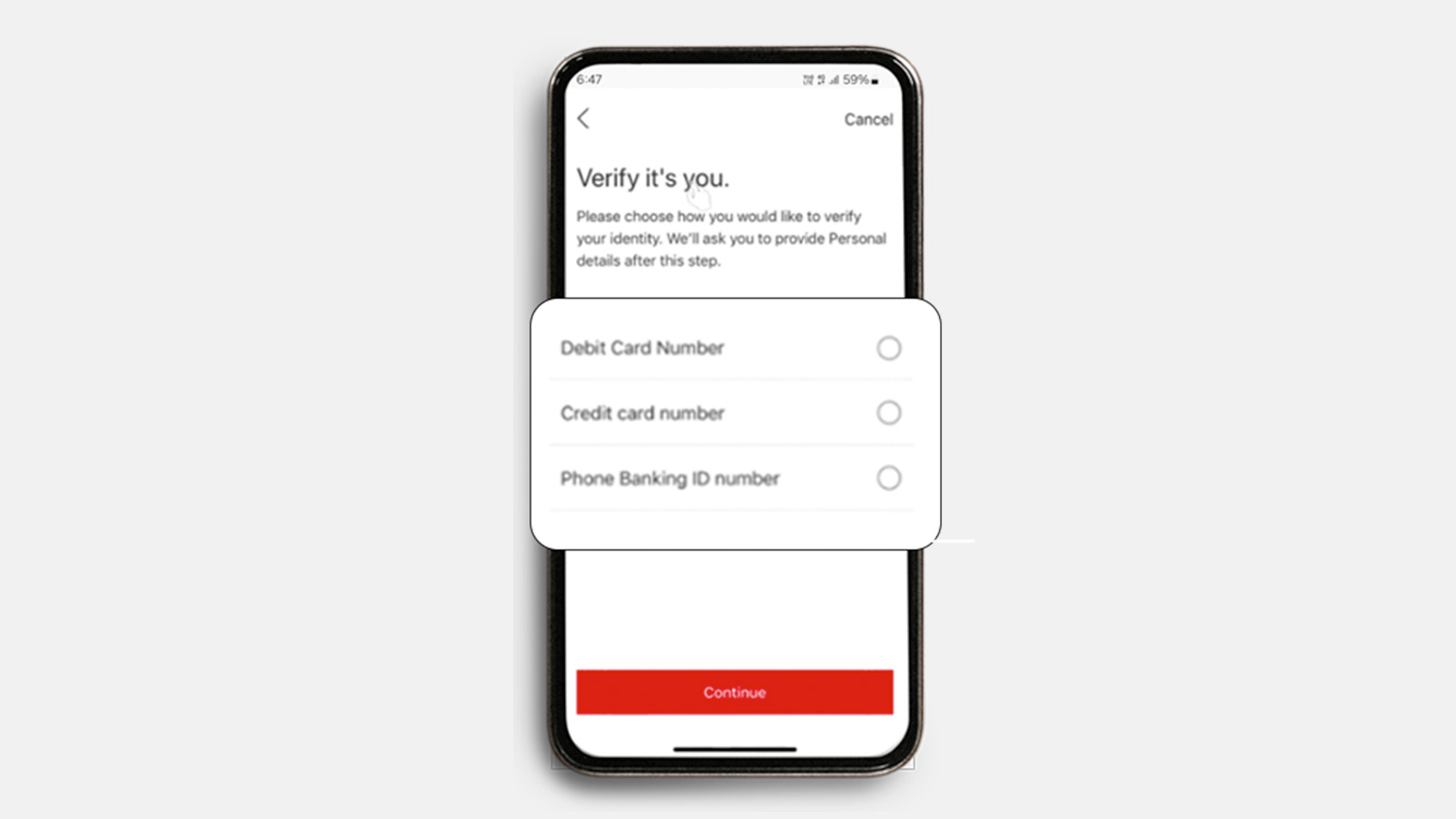

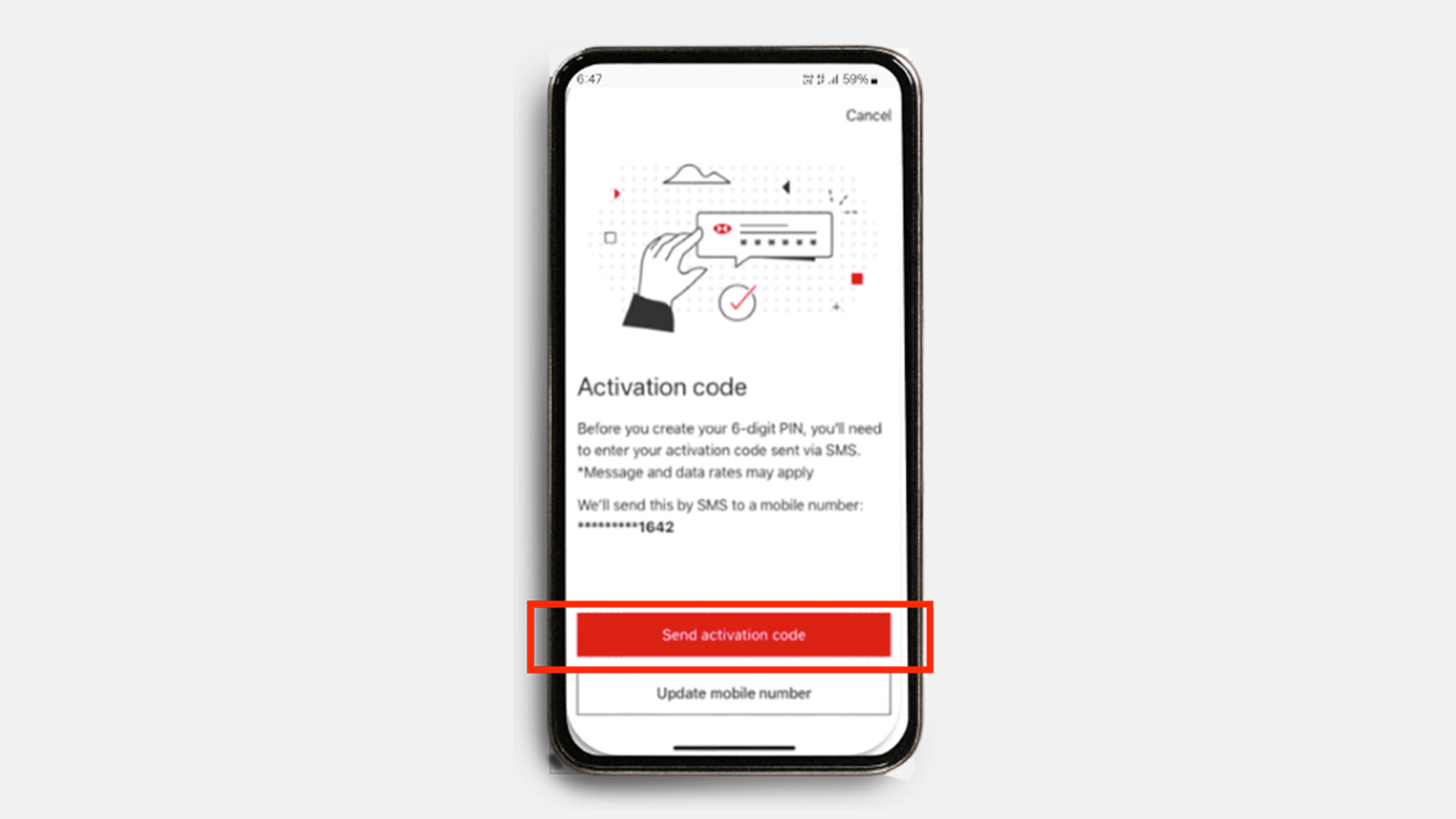

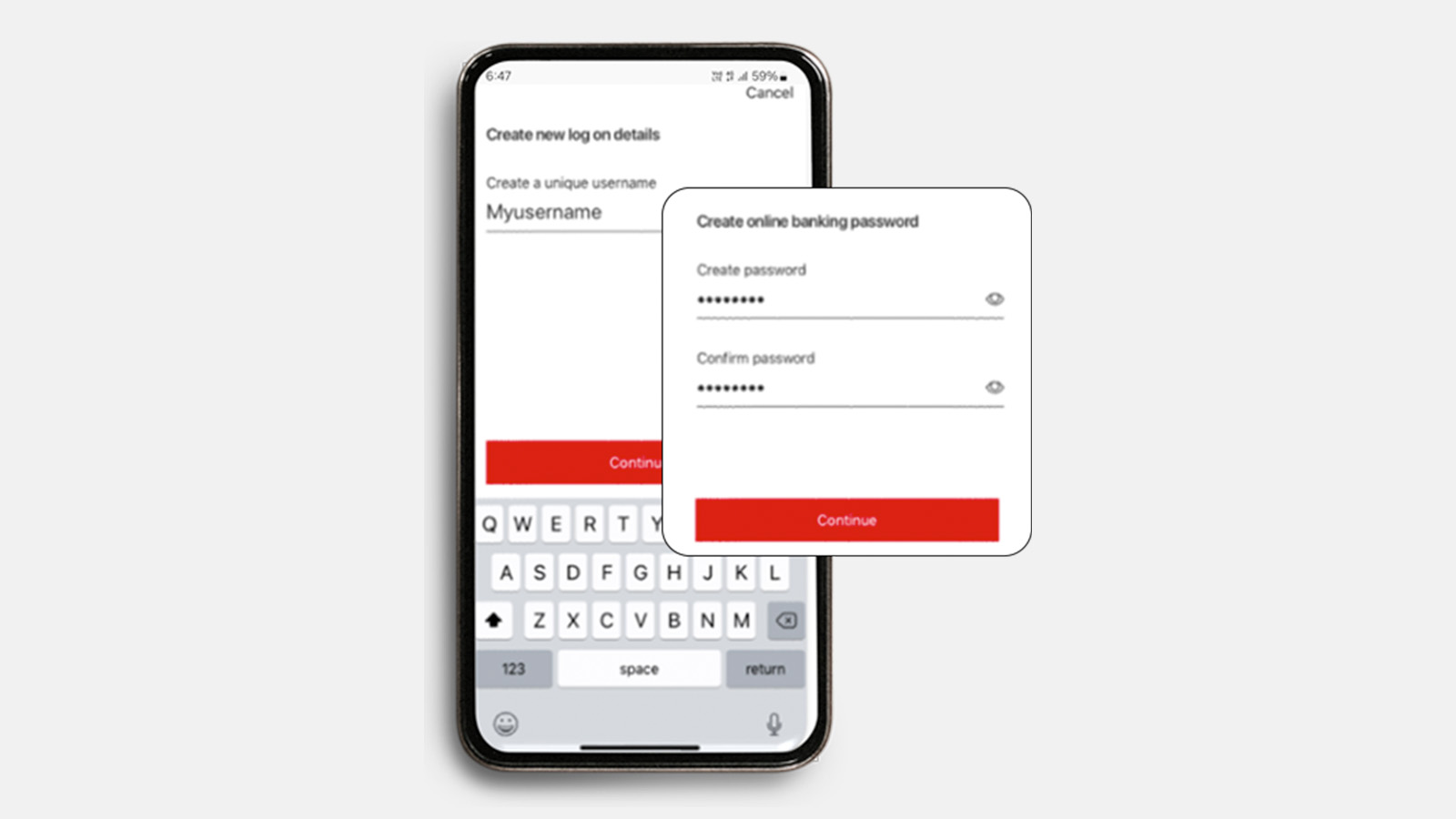

How to get started

What you can do on the app

- Activate and manage credit card PINYou can activate your HSBC credit card and manage your PIN easily. Learn how to activate your credit card (PDF).

- Check credit card transactions with easeYou can access credit card details such as transaction history, credit limit and billing statement. Learn how to check your credit card transactions (PDF).

- Free transfers with BI-FASTEnjoy free interbank transfers with the BI-FAST feature. You can also set a daily transfer limit of up to IDR250 million per transaction. Learn more about transfers and account transactions (PDF).

- Enjoy competitive interest rates for deposits and savingsEarn higher interest rates (compared to regular savings) with an HSBC High Rate Savings Account and time deposits available in both IDR and foreign currencies. Learn how to open a savings account (PDF).

- Seamless international accessManage your HSBC account seamlessly across the countries with Global View and Global Transfers, and enjoy easy transfers with 12 currencies available in HSBC. Learn how to make international transfers (PDF).

- Start your investment journey easilyDigital investment account opening (DIAO) helps you to open an investment account easily. Fill in the risk profile questionnaire to assess investment products suitable to your needs. Learn how to open an investment account (PDF).

- Monitor and explore various investment optionsExperience seamless mutual fund transactions with competitive administration fees, and enjoy a broad range of options for trading bonds across primary (PDF) and secondary (PDF) markets. Learn how to buy mutual funds and bonds (PDF).

- Upload and review investment documentsYou can upload, review and acknowledge your investment transaction documents through mobile banking. Learn how to review investment documents (PDF).

- Access insurance coverage summaryInsurance dashboard feature makes it easy for you to access Allianz insurance policies. Learn how to view your insurance dashboard (PDF).

Other app features

Frequently asked questions about mobile banking

Frequently asked questions about app features

Frequently asked questions about managing credit cards on the app

Download the app

For the quickest and smartest way to bank download the app, it should only take a minute.

Scan the code with a mobile device, it will take you straight to your app store.